Tactical Hedging: a Quick Guide

- Fred Dionne

- Sep 9, 2025

- 10 min read

Updated: Oct 10, 2025

Tactical hedging or implementing a short term position to reduce the risk exposure of your core portfolio, is a tactic that can be implemented by active investors to improve (quite significantly sometimes) their risk-adjusted returns while reducing the risk of loss.

Readers' note: some concepts may be oversimplified to facilitate their understanding.

In this article I will cover the following:

When tactical hedging may be warranted;

5 easy steps to implement cost-efficient tactical hedging;

A real example of tactical hedging that I implemented during the Trump 2.0 Confidence Crisis;

When tactical hedging may be warranted

When a change in market conditions or a key market event triggers a reversal in markets, using tactical hedging can significantly reduce your overall risk exposure. A tactical hedging may be warranted when a catalyst arises and when a reversal is triggered from a technical standpoint:

by market participants showing conviction at a key inflection point often highlighted by a contraction in price volatility - this is what I call a change in the Market Profile Structure where buyers or sellers overwhelm the other side with a wave of strong buying (selling) - it necessarily starts with a trend day after a catalyst, and a wide range bar;

following an important standard deviation moves as measured by the average true range, a target reached or a wide range bar that highlights exhaustion conditions;

by responsive sellers (or buyers if you are short) with conviction as displayed with a selling tail (or buying tail);

by a failed auction, which often precedes big moves in the other direction of the initial auction - the sling-shot effect;

similarly, by a failed consolidation at higher (lower prices) with a lower high (higher low if you are short);

with the break of a key trendline;

I will give examples of each of them in subsequent articles.

I use futures contracts on equity indices available on the Chicago Mercantile Exchange (CME) to hedge a core portfolio of stocks, commodities, bonds and currencies. Put options could also be used but I find that solution somewhat less efficient for tactical hedging purposes when speed, liquidity and flexibility in its implementation are necessary. It's worth noting that one key advantage of using options is that the risk of loss for the tactical hedge is limited to the option premium paid which, generally speaking, will vary based on the time to the option's expiration date and the volatility of the underlying instrument (precision added following a very relevant comment by a reader).

5 easy steps to implement a cost-efficient tactical hedging position

Let’s look at how an active investor can implement tactical hedging using futures contracts in 5 easy steps:

STEP 1 (optional): open an account with a broker that allows you to trade futures in addition to your favorites instruments (stocks, ETFs, etc.). Interactive Brokers is a well known broker used by many prop traders.

Futures allow you to trade with significant leverage (10x or more). I would never recommend such a high ratio of leverage for speculative purposes unless you (really) know how to size and risk managed your positions adequately. However, for hedging purposes, the more leverage you can use, the better. Bigger leverage means you need a smaller position to protect your core positions. A smaller position for hedging purposes will free up capital such that you can add to your core positions when prices become attractive again and it will also mean lower cost.

This step is optional because you can also initiate a tactical hedging position using exchange traded funds or ETFs. ETFs trade like stocks. For instance, you could go short the S&P500 by buying an inverse ETF like SPXU, with 3 times the leverage of SPY, or go short the SPY.

Note that futures contracts are complex financial instruments that use leverage and abide by a set of particular rules. Futures contracts have specific margin requirements. Futures contracts have a short expiry date (usually one month to a few months). As such, they may need to be closed or rolled over before their expiry date, triggering additional fees on such calendar rollover.

STEP 2: understand your weighted position values (WPV) and the correlation of your individual positions with respect to a given underlying instrument.

For instance, let’s assume that our market bias is to the long side (i.e. we expect equities to trend higher) and as such we have taken the following (hypothetical) positions:

$50K short US 10 year yields*

$50K long AAPL

$50K long AMZN

$50K long NVDA

$50K long BTC

$50K long EUR

$50K long GOLD

* the equivalent of being long 10Y bonds

Now, we need to determine the correlation for each individual position that we have relative to the S&P 500 (we will use the SPY, it's ETF equivalent), which is the index that we will use for tactical hedging purposes.

A correlation coefficient of 1 means that the instrument is perfectly correlated a coefficient of 0 means there is no correlation a coefficient of -1 means there is a perfectly inverse correlation.

For the purpose of determining such correlation, we will assume that every position with a correlation factor greater than > 0.35 is put in the Positively Correlated Basket of Securities and lower than < -0.35 is put in the Negatively Correlated Basket of Securities. Anything in-between will be put in the Neutral Basket of Securities. We are simplifying the calculation of course but this can still represent a good starting point to create different baskets of correlated and non-correlated securities.

Note that the correlation coefficient will always vary based on different market conditions (for instance, in inflationary market conditions, stocks and bonds might become correlated like they were back in 2021-2022).

There are many ways to calculate the correlation. In TradingView you can use the correlation coefficient indicator and calculate it relative to SPY for instance.

STEP 3: Once you have created your 3 correlation baskets: Positively Correlated, Negatively Correlated and Neutral, you need to calculate the weighted position values (WPV) for the securities held in each of those baskets. These are calculated using the volatility or average true range (ATR) of each instrument relative to the SPY (in our example). I use a 50-day ATR to calculate the WPV. You can try a longer period such as 200-day or a much shorter period such as 10-day ATR (less reliable), etc.

In TradingView you can use the ATR Percentage indicator to display the daily average true range as a percentage. The chart below shows the daily bar chart of gold with 3 indicators underneath: a positive correlation coefficient of 0.52, a daily ATR of 48.94 points over the last 50 trading days and finally the daily ATR percentage of 1.346 over the last 50 trading days. It means that for the last 50 trading days, gold moved by 1.346% on average.

ATR is hugely important to help you determine the right position sizing. The 3 biggest mistakes newbie investors and traders make are: A) overconcentration in only a few securities; B) overlooking cross-instrument and cross-market correlation; and C) oversizing their positions, often using way too much leverage.

Now let`s determine the volatility of each instrument relative to the SPY, the instrument that we will use for tactical hedging purposes.

Because the SPY has a daily ATR percentage of 1.02% over the same 50-day period, we can determine that GOLD is, on average, 32% more volatile than SPY over the same period (1.346 / 1.02). This means that the $50K in nominal value of our Gold position must be increased by 32% to get to a Weighted Position Value (WPV) of $66K (50K * 1.32).

Let's do the exercise for the whole portfolio listed below:

$50K Short US 10 year yields* with a correlation of -0.48 - ATR % of 0.46%

$50K Long AAPL with a correlation of 0.89 and an ATR % of 2.04%

$50K Long AMZN with a correlation of 0.60 and an ATR % of 2.22%

$50K Long NVDA with a correlation of 0.70 and an ATR % of 2.83%

$50K Long BTC with a correlation of -0.32 and an ATR % of 2.59%

$50K Long EUR with a correlation of -0.08 and an ATR % of 0.73%

$50K Long GOLD with a correlation of 0.52 and an ATR % of 1.346%

* calculated on 10Y bonds not on yields

Now let's calculate the WPV, and classify each instrument in the right correlation basket:

Positively Correlated

$100K WPV Long AAPL (2.04 / 1.02)

$109K WPV Long AMZN (2.22 / 1.02)

$139K WPV Long NVDA (2.83 / 1.02)

$66K WPV Long Gold (1.346 / 1.02)

$127K Long BTC (see note below)* ???

TOTAL WPV for this BASKET: $541K

Negatively Correlated

$22.5K WPV Short US 10 year yields (0.46 / 1.02)

TOTAL WPV for this BASKET: $22.5K

Neutral

$36K WPV Long EUR (0.73 / 1.02)

$127K Long BTC (see note below)* ???

TOTAL WPV for this BASKET (excl BTC): $36K

* BTC currently currently falls into our neutral basket because its 50-day correlation coefficient is -0.32. However, this does not seem right as BTC should be considered as a risk asset. Let`s look at a 200-day correlation coefficient: it`s at 0.86! It is up to you to decide whether you want your tactical hedge to also cover the BTC holding. I would add it in the Positively Correlated Basket, expecting the short term correlation to flip back up if we get a trigger for reversal in risk assets.

It's all about picking the right datasets and common sense ahaha!

Now let`s look at a 200-day correlation coefficient: it`s at 0.86 !

So here is what most newbie investors and traders fail to understand.

The volatility adjusted position value or WPV of the instruments classified in the Positively Correlated Basket of risk assets is more than 2.16X its nominal value ! $541K versus $250K. This is key to understand when you want to manage your position risk profile and implement a tactical hedging position.

The net WPV that an investor could consider hedging from would therefore be as follows:

$541K minus the Negatively Correlated Basket of $22.5K and the Neutral Basket of $36K = $482.5K WPV.

Now we have a weighted position value of $482.5K that we can work with ! Keep in mind that we may have oversimplified this calculation and how we assign an instrument to a particular basket but this simple process and calculation are a good starting point for anyone who considers risk exposure as a priority.

STEP 4 : prepare for a change in market conditions or reversals.

You will be able to do this with a bit of experience and understanding market positioning, the prevailing market narratives, technical setups and other changes in market conditions. Timing skills will be important here.

Understanding the Market Profile can be very useful for such purposes. See also the CBOT Market Profile Handbook.

STEP 5 : Once you see changes in conditions for a key reversal happen - this requires advance preparation obviously - open a tactical hedging position by shorting the nearby futures contracts for the SP500 (closest to expiration) - or alternatively, go long SPXU, the inverse SPY ETF.

One e-mini contract represents $50 per SP500 point so multiply 6510 (the price at which the e-mini futures contract is trading) by 50 = $325.5K.

The e-mini contract is the most liquid futures contract in the world so you can hedge millions of dollars in a matter of seconds. Don’t worry you won’t move the market with 10 e-mini contracts ($3.25M)! :-)

If one e-mini contract is too large of a size given the amount you need to hedge against, use a micro contract which represents $5 per SP500 point. That is 6510 * 5 = $32.5K

To initiate a futures position, you'll need to have sufficient funds to cover your margin requirement which is less than 1/10th the nominal value of your futures contract. Obviously, make sure you have additional room in margin requirements in order to avoid a margin call ! You can find more information on margin requirements here.

So the moment has finally come to trigger a tactical hedging trade ! How exciting! FEAR market correction NO MORE!

Hypothetical : On FOMC day at 2:45PM, you see a reversal based on a rejection of higher prices when the Fed Chair sounds way more hawkish than market participants expected and he shows Trump the finger (!). Wait, really ?!? Ahaha. Sellers conviction becomes obvious and prices push quickly to the downside as seen by a big selling tail.

Here is what I mean by a selling tail that shows conviction from sellers:

You have been preparing for this. You swiftly pull the trigger by shorting 1 e-mini SP futures contract and 5 micro SP futures contracts. Your goal is to hedge an amount close to $482.5K: $325.5K (1 e-mini) + $157K (5 micro, rounded up).

While this would not represent a perfect hedge, far from it, it sure is a good protection to limit the loses of your core positions in your Positively Correlated Basket of risk assets should the market breaks to the downside.

If you have conviction that a short term break to the downside may accelerate then you may short more futures contracts to create a net short position, beyond simply protecting your core long positions. You can then cover your short position once the market gets oversold and conditions for a reversal to the upside materialize.

It may also represent an opportunity to average down on some positions that have become more attractive from a value perspective.

Real Tactical Hedging Position implemented during the Trump 2.0 Confidence Crisis.

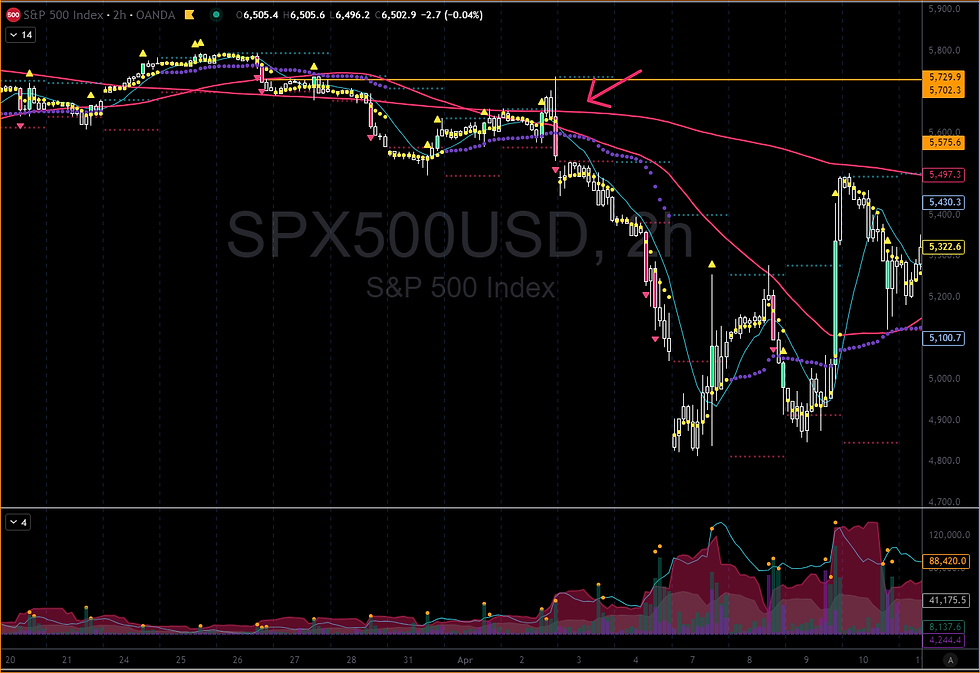

On April 2nd 2025, I implemented a tactical hedge to reduce the downside exposure to my core long positions, as well as to profit from a short term trend down. This was the day Trump displayed his famous tariff board to the world. Remember ?

From a technical standpoint, the change in market structure was very obvious. I was rightly expecting a swift rejection at a key prior support level highlighted by the November-March consolidation, once we had broken from such level.

I covered the tactical hedge on Sunday evening (yes equity futures markets are opened on Sunday evening so you can act preemptively before most investors can!). The SP futures market gapped down in the 4800s, which represented a key support area according to the 3-year SPX Market Profile analysis. This was a third consecutive gap down showing signs of exhaustion. Furthermore, I added to my long positions using futures contracts as well as equity index ETFs (SPY, SPXL, QQQ, TQQQ). These trades were implemented in a matter of minutes.

This hedging tactic allowed me to generate excess alpha and beat the benchmark performance for the year by 12%+ while optimizing my risk profile and measures relative to the key equity benchmarks - while being only 25% invested.

You can see in the chart above how my P&L (blue line) was pretty much tracking the major equity benchmarks since the beginning of the year. Like most investors, I had not seen coming the new aggressive agenda on tariffs. However, my P&L curve stabilized and flipped back up when the tactical hedge was implemented and new long positions were taken at the beginning of April. Profits were taken when the 20% mark was reached.

Conclusion

Tactical hedging using futures or ETFs on equity indices can represent a fast, furious and efficient way to protect your portfolio and also generate alpha if your position sizing and tactical timing are well executed.

Are you ready to implement your own tactical hedging?

Comments